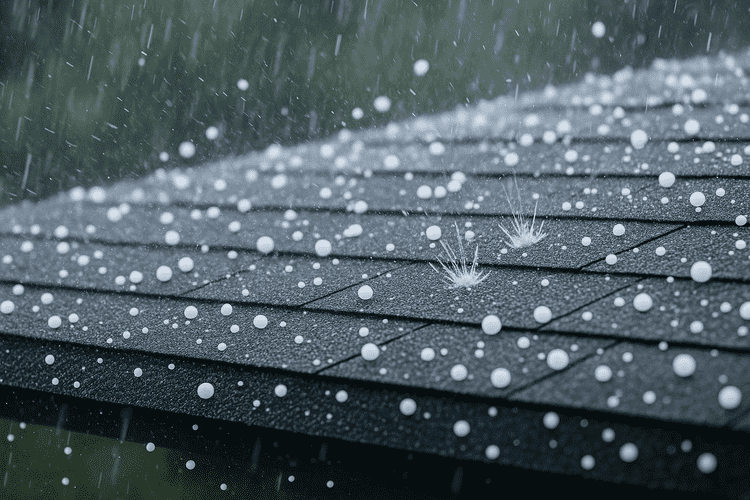

Protect Your Home from Wind & Hail Costs with SOLA Insurance

Severe wind and hail storms are all too common across Kansas and Missouri. Unfortunately, many homeowners are now facing steep deductibles when damage occurs—sometimes thousands of dollars out of pocket. At Blue Valley Insurance Agency, we understand how frustrating this can be, and that’s why we’re excited to offer a new solution: SOLA Wind & Hail Insurance.

Why SOLA?

Traditional homeowners policies are increasing wind/hail deductibles—often set at 1% or more of your home’s insured value. For a $400,000 home, that could mean $4,000 or more in deductible costs before your carrier pays a dime. SOLA is designed to bridge that gap.

Covers your wind/hail deductible: SOLA pays up to your selected limit (from $2,000–$25,000) to offset what your home insurance doesn’t cover

Affordable way to manage premiums: By carrying a higher deductible on your main policy, you can lower your homeowners premium and let SOLA handle the risk

Extra help for older roofs: If your roof is on a scheduled payout or depreciated, SOLA helps cover the gap to make sure repairs can be made

How It Works

SOLA uses a straightforward, four-step process:

A wind, hail, or tornado event occurs.

You submit photos of the damage.

SOLA verifies the storm using National Weather Service data—no adjuster needed.

You receive a payout to cover your deductible or related out-of-pocket costs.

It’s fast, simple, and designed to get you back on your feet quickly.

Key Advantages for Homeowners

No deductible on the SOLA policy itself

Claims are not reported to CLUE (your historical insurance report), so they won’t affect your future insurability

No premium increases or non-renewals after a claim

Flexible billing: monthly or annual, with discounts for annual pay

Backed by A-rated reinsurers through Lloyd’s of London

Available in Kansas & Missouri

SOLA is currently available in eight states, including Kansas and Missouri, making it a smart option for homeowners here in the Midwest storm belt

Is SOLA Right for You?

SOLA is a great fit if you:

Have a high wind/hail deductible you’re concerned about affording.

Want to lower your homeowners premiums without sacrificing peace of mind.

Own a home with an older roof that could leave you exposed to depreciation.

Ready to Learn More?

As one of the leading independent insurance agencies in the Kansas City Metro, Blue Valley Insurance Agency is here to help you understand your options and protect your home from unexpected costs.

👉 Contact us today to learn how SOLA can fit into your insurance plan and give you confidence before the next storm hits.

Discussion

There are no comments yet.